Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.

Fluence raised US$1 billion through an IPO in October this year. At the time, it claimed that its operating income in 2021 will reach a record of US$680.766 million, which is higher than the US$561 million in 2020.

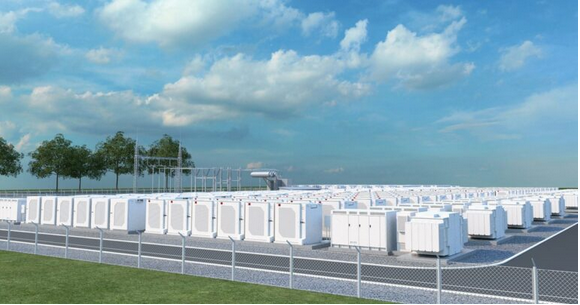

The rendering of the 150MW Hazelwood battery energy storage project that Fluence started construction in Australia

This year, Fluence signed a 1311MW energy storage system contract, a 1959MW energy service contract and a 2,744MW Fluence IQ digital software contract, all of which are record numbers for the company.

However, the company's net loss also increased significantly. The net loss in fiscal 2020 is US$47 million, and the net loss in fiscal 2021 will reach US$162 million.

The company said that the loss was driven by multiple factors, including supply constraints and increased shipping costs, which have had an impact on many industries around the world, mainly due to the adverse effects of the new crown epidemic.

Some of Fluence's energy storage projects under construction have also experienced cost overruns and deployment delays, and the company's business growth and scale expansion have also promoted increased expenditures in areas including administration, sales, marketing, and research and development.

The company also reported an incident earlier this year that resulted in the company’s inventory loss of $11.4 million: an accident on a ship carrying Fluence’s energy storage system caused damage to its cargo. Fluence hopes to recover most of the losses through insurance company claims.

The company also expects that in 2022, there are still many issues (such as supply delays and temporary closures of sites related to the new crown epidemic) that need to be resolved, which will be reflected in revenue in 2022.

After the initial public offering, Fluence ceased to be in debt and established a $190 million revolving credit facility.

Industry media reported on many of Fluence's construction projects and awarded contracts this year. Recently, Fluence began to deploy four energy storage systems with a total scale of 200MW/200MWh, which will be used as virtual transmission network resources.

Earlier this month, ENGIE and Macquarie Green Investment Group cooperated to open and operate a privately invested 150MW/150MWh battery energy storage project in Australia. The project also provided ENGIE with a contract for optimization using Fluence IQ software. And a 20-year service contract.

In addition to reports on Fluence's digital and software services, industry media also reported the company's deployment of other large-scale battery energy storage projects in the Philippines, Italy, Ireland, and Germany.

Fluence's leadership held an earnings conference call later on December 9 to discuss the company's future performance development.

March 29, 2023

January 11, 2023

January 31, 2023

December 06, 2022

この仕入先にメール

March 29, 2023

January 11, 2023

January 31, 2023

December 06, 2022

Mr. Jerry Wang

電話番号:

+86-514-82106897

Fax:

E-mail:

モバイルサイト

Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.

Fill in more information so that we can get in touch with you faster

Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.